H.R. 493: Federal Adjustment of Income Rates Act

This bill, known as the Federal Adjustment of Income Rates Act (FAIR Act), aims to increase pay rates for federal employees. Here are the key components of the bill:

Adjustment to Rates of Pay

- Statutory Pay Systems: For the year 2026, the basic pay rates for federal employees under statutory pay systems will be adjusted by 3.3%.

- Prevailing Rate Employees: The bill also specifies that for fiscal year 2026, the pay rates for prevailing rate employees—those who are paid based on market rates in a given geographic area—will see a similar increase of 3.3%. This adjustment takes place regardless of standard wage survey requirements.

Adjustment to Locality Pay

- The bill proposes that locality pay, which is additional compensation based on the cost of living in different areas, will be increased by 1% for calendar year 2026.

The overall goal of this legislation is to ensure that federal employees receive a fair adjustment in their pay to keep up with economic conditions and cost-of-living changes.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

Sponsors

33 bill sponsors

-

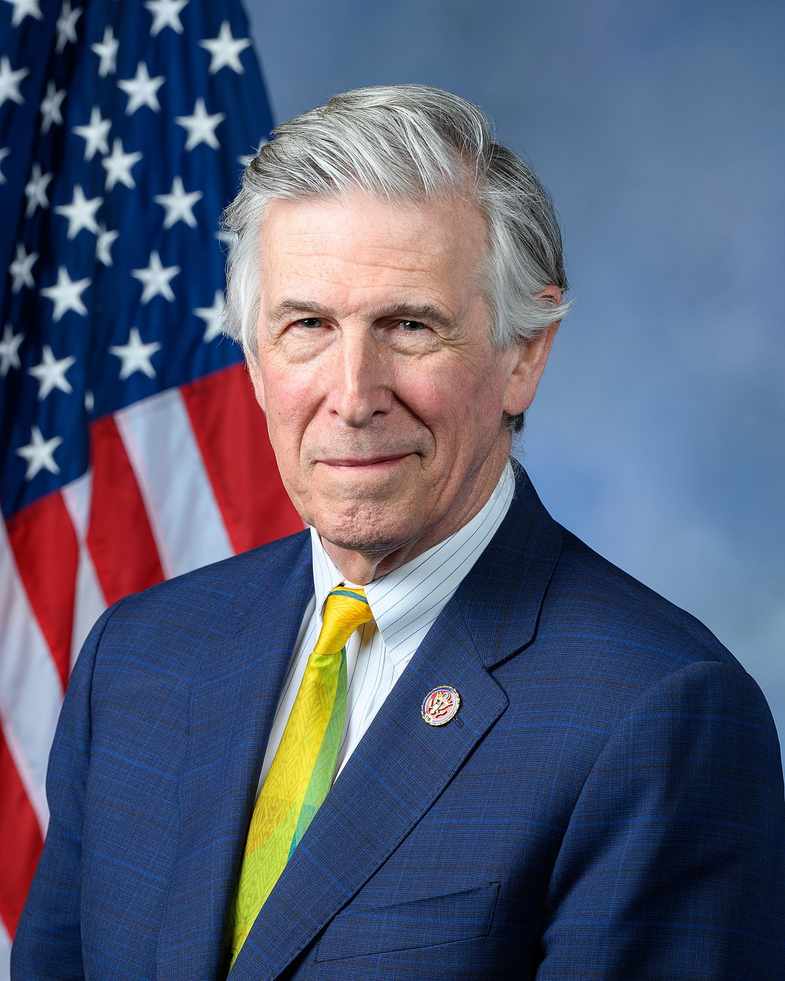

TrackGerald E. Connolly

Sponsor

-

TrackYassamin Ansari

Co-Sponsor

-

TrackNanette Diaz Barragán

Co-Sponsor

-

TrackDonald S. Beyer, Jr.

Co-Sponsor

-

TrackJulia Brownley

Co-Sponsor

-

TrackNikki Budzinski

Co-Sponsor

-

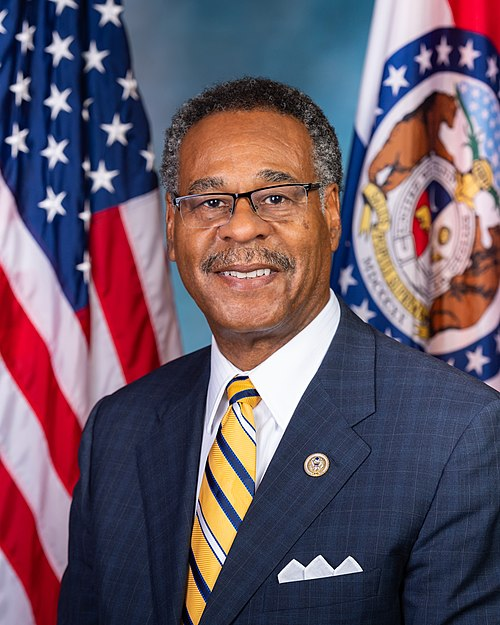

TrackEmanuel Cleaver

Co-Sponsor

-

TrackDiana DeGette

Co-Sponsor

-

TrackSuzan K. DelBene

Co-Sponsor

-

TrackSarah Elfreth

Co-Sponsor

-

TrackDwight Evans

Co-Sponsor

-

TrackShomari Figures

Co-Sponsor

-

TrackBrian K. Fitzpatrick

Co-Sponsor

-

TrackRobert Garcia

Co-Sponsor

-

TrackSteny H. Hoyer

Co-Sponsor

-

TrackVal T. Hoyle

Co-Sponsor

-

TrackGlenn Ivey

Co-Sponsor

-

TrackJulie Johnson

Co-Sponsor

-

TrackSummer L. Lee

Co-Sponsor

-

TrackMike Levin

Co-Sponsor

-

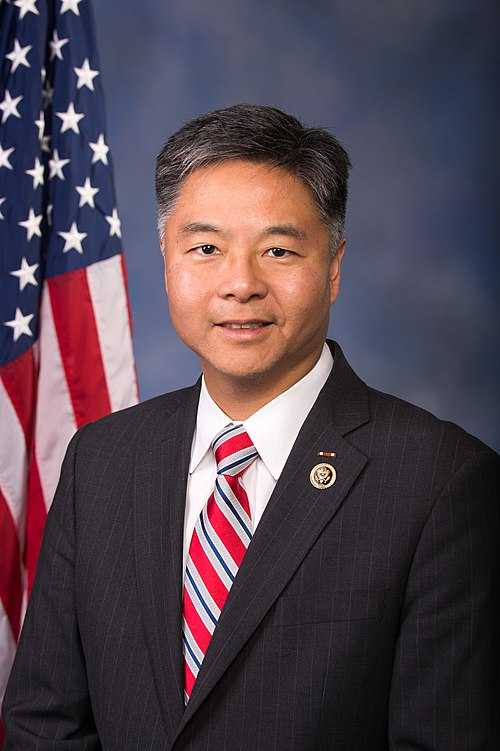

TrackTed Lieu

Co-Sponsor

-

TrackStephen F. Lynch

Co-Sponsor

-

TrackJames P. McGovern

Co-Sponsor

-

TrackKweisi Mfume

Co-Sponsor

-

TrackFrank J. Mrvan

Co-Sponsor

-

TrackDonald Norcross

Co-Sponsor

-

TrackEleanor Holmes Norton

Co-Sponsor

-

TrackIlhan Omar

Co-Sponsor

-

TrackEmily Randall

Co-Sponsor

-

TrackAndrea Salinas

Co-Sponsor

-

TrackMary Gay Scanlon

Co-Sponsor

-

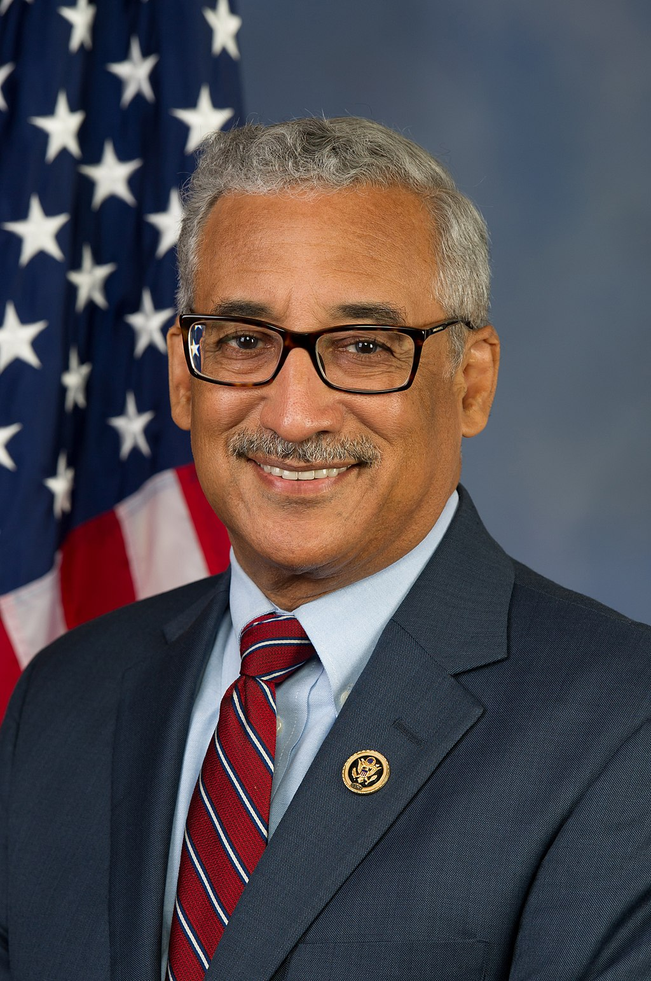

TrackRobert C. "Bobby" Scott

Co-Sponsor

-

TrackSuhas Subramanyam

Co-Sponsor

Actions

3 actions

| Date | Action |

|---|---|

| Sep. 16, 2025 | ASSUMING FIRST SPONSORSHIP - Mr. Walkinshaw asked unanimous consent that he may hereafter be considered as the first sponsor of H.R. 493, a bill originally introduced by Representative Connolly, for the purpose of adding cosponsors and requesting reprintings pursuant to clause 7 of rule XII. Agreed to without objection. |

| Jan. 16, 2025 | Introduced in House |

| Jan. 16, 2025 | Referred to the House Committee on Oversight and Government Reform. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.