H.R. 5276: Community Bank Leverage Improvement and Flexibility for Transparency Act

This bill, known as the Community Bank Leverage Improvement and Flexibility for Transparency Act, aims to modify specific provisions related to community banks' leverage ratio as established by previous legislation. The key points of the proposed changes are outlined below:

1. Community Bank Leverage Ratio Adjustment

The bill proposes the following changes to the Community Bank Leverage Ratio (CBLR), which is a regulatory measure for qualifying community banks:

- It increases the asset threshold for community banks from $10 billion to $15 billion. This means that community banks with total assets up to $15 billion can qualify for a simplified capital requirement.

- It reduces the capital requirement range for the leverage ratio from not less than 8% and not more than 10% to not less than 6% and not more than 8%. This modification lowers the amount of capital that community banks need to hold relative to their total assets.

2. Rulemaking Deadline

The bill stipulates that within 180 days of its enactment, relevant regulatory agencies, including the Federal Reserve, the Office of the Comptroller of the Currency, and the FDIC, must propose rules to implement these changes. Additionally, they must finalize these rules within one year of the bill's enactment.

3. Review of the Community Bank Leverage Ratio

Regulatory agencies are required to conduct a comprehensive review of the CBLR aimed at:

- Encouraging more community banks to participate in the CBLR framework, especially those with fewer assets.

- Reducing the compliance burden on community banks to make the CBLR easier to understand and apply.

Following this review, a report must be submitted to the relevant congressional committees within 150 days of the bill’s enactment. This report should include:

- Findings and determinations from the review.

- Recommendations for modifications, including adjustments to the CBLR numerator and denominator, treatment of specific asset classes, defining criteria for qualifying community banks, and procedures for opting in or out of the CBLR framework.

- Consideration of any statutory changes that may be needed based on the recommendations.

4. Definition of Qualifying Community Bank

The bill maintains the definition of a "qualifying community bank" as outlined in the prior legislation regarding the CBLR. This term typically refers to smaller, community-focused banks that have certain asset characteristics that allow them to utilize the simplified regulatory framework.

Relevant Companies

- WFC - Wells Fargo & Company: As a financial services company with significant community banking operations, changes in CBLR can impact how they manage capital requirements.

- USB - U.S. Bancorp: Similar to Wells Fargo, U.S. Bancorp could see impacts in terms of regulatory compliance and capital management due to these adjustments to the leverage ratio.

- PNC - PNC Financial Services Group: PNC may also be affected as these changes could influence their capital strategies and regulatory framework for their community banking operations.

This is an AI-generated summary of the bill text. There may be mistakes.

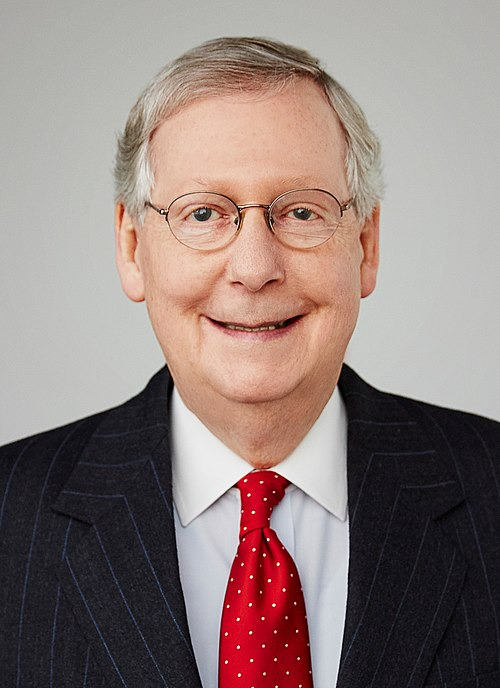

Sponsors

1 sponsor

Actions

4 actions

| Date | Action |

|---|---|

| Sep. 16, 2025 | Committee Consideration and Mark-up Session Held |

| Sep. 16, 2025 | Ordered to be Reported (Amended) by the Yeas and Nays: 33 - 19. |

| Sep. 10, 2025 | Introduced in House |

| Sep. 10, 2025 | Referred to the House Committee on Financial Services. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.