H.R. 5317: Community Bank Deposit Access Act of 2025

The Community Bank Deposit Access Act of 2025 aims to make specific changes to the Federal Deposit Insurance Act related to custodial deposits received by certain smaller, well-capitalized banks. Here's what the bill proposes:

Custodial Deposits Exception

The bill allows custodial deposits from eligible institutions to be exempt from being classified as funds acquired through deposit brokers, as long as these deposits do not exceed 20% of the total liabilities of the institution. In simpler terms, if a bank is handling deposits on behalf of others (like from trust accounts or retirement plans), these can be treated differently if they make up a small portion of the bank's overall liabilities.

Definitions

Key terms defined in the bill include:

- Custodial Deposit: This refers to deposits made to banks for the benefit of third parties through agents or trustees.

- Eligible Institution: This is a bank with less than $10 billion in total assets, that is well-capitalized, and has a good record from recent examinations.

- Well Capitalized: This term refers to a bank that meets certain capital adequacy standards set by regulators.

Interest Rate Restrictions

The bill modifies rules around the interest rates that can be paid on custodial deposits, particularly for institutions that don’t meet the “well-capitalized” definition. The main points are:

- Covered institutions are prohibited from offering interest rates that significantly exceed local market rates.

- The allowable interest rate must be in line with the rates paid on similar maturity deposits either in the local market or national averages.

Implementation and Oversight

The changes introduced by this bill are intended to support smaller banks and community banks with managing custodial deposits while maintaining regulatory compliance and financial stability. By lessening the compliance burden in certain areas, the bill aims to enhance access to banking services for clients relying on custodial accounts.

Relevant Companies

- USB - U.S. Bancorp: As a significant player among regional banks, the changes may affect how they handle custodial deposits.

- WFC - Wells Fargo & Company: With a large banking presence, the regulations may influence their custodial deposit practices.

This is an AI-generated summary of the bill text. There may be mistakes.

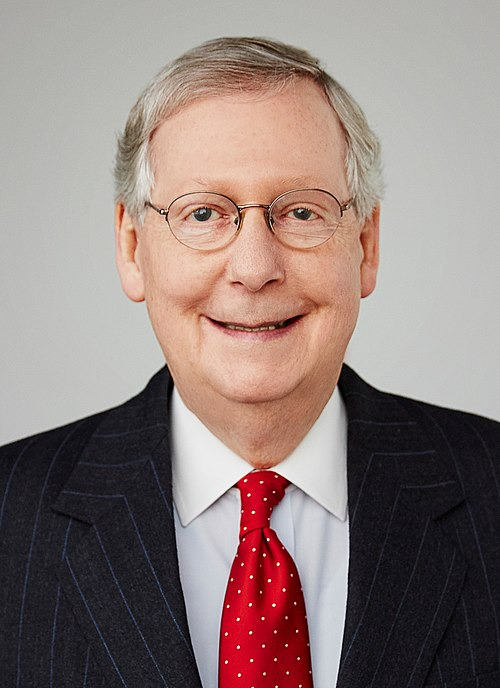

Sponsors

1 sponsor

Actions

4 actions

| Date | Action |

|---|---|

| Sep. 16, 2025 | Committee Consideration and Mark-up Session Held |

| Sep. 16, 2025 | Ordered to be Reported (Amended) by the Yeas and Nays: 48 - 2. |

| Sep. 11, 2025 | Introduced in House |

| Sep. 11, 2025 | Referred to the House Committee on Financial Services. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.