S. 2818: A bill to amend the Internal Revenue Code of 1986 to impose a corporate tax rate increase on companies whose ratio of compensation of the CEO or other highest paid employee to median worker compensation is more than 50 to 1, and for other purposes.

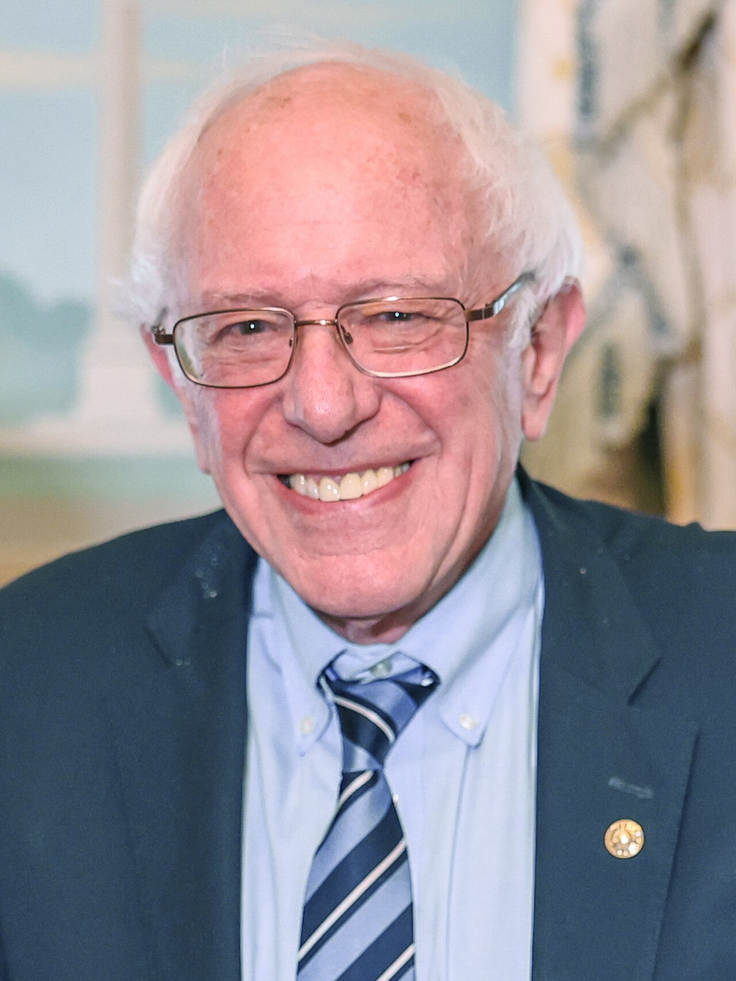

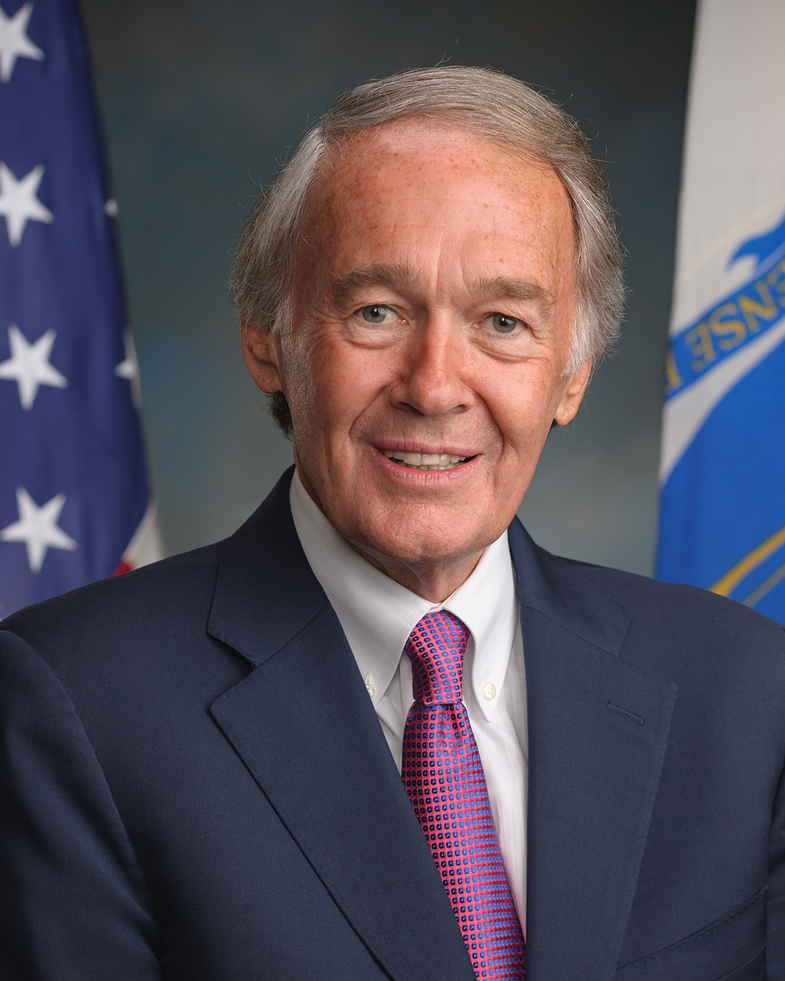

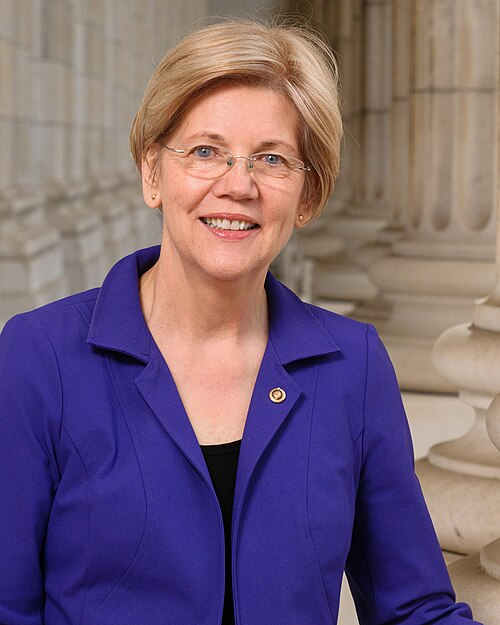

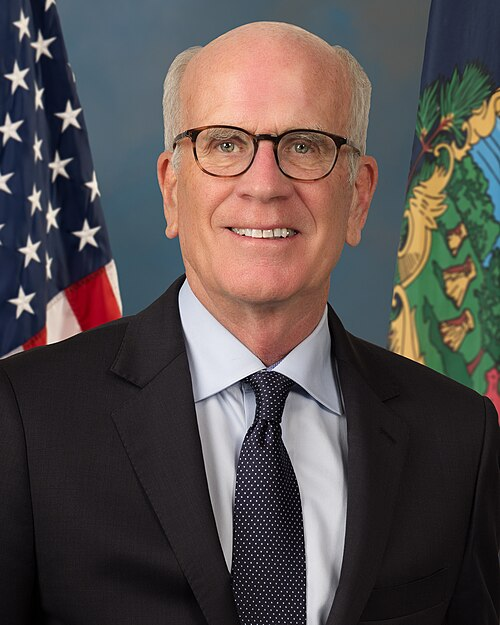

Sponsors

5 bill sponsors

Actions

2 actions

| Date | Action |

|---|---|

| Sep. 16, 2025 | Introduced in Senate |

| Sep. 16, 2025 | Read twice and referred to the Committee on Finance. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.