S. 855: Royalty Transparency Act

This bill, known as the Royalty Transparency Act, aims to enhance the financial disclosure requirements for certain federal employees in relation to royalties received from inventions. Here are the main components of the bill:

1. Financial Disclosure Reports of Executive Branch Employees

The bill expands the categories of individuals required to report their financial disclosures, specifically targeting members of various advisory committees that influence public health, biotechnology, and more. These individuals must report:

- Any royalties they receive from inventions developed during their employment with the U.S. Government.

- The original source and amount of these royalties, including payments linked to federal technology transfer agreements.

2. Reporting and Accountability

The act mandates that the Government Accountability Office (GAO) will create a list of advisory committees that have made recommendations pertaining to public health, which must be published at least once a year. This list will reflect the committees that have had their suggestions implemented within the past decade.

3. Agency Reports and Public Disclosure

Each agency is required to submit annual reports on the financial disclosures of their employees, specifically focusing on confidential disclosures for those who are required to file. Furthermore, agencies must:

- Publish a list of employees who receive royalties and the details of these royalties on their websites.

- Ensure transparency about the payment of royalties and any potential conflicts of interest derived from these payments during contractor or grantee reviews.

4. Waivers and Notification

If any exemptions or waivers from these reporting requirements are granted, they must be reported to relevant congressional committees along with a justification for the waiver. This includes any waivers that might occur under ethical review processes.

5. Sunset Provision

The amendments made by this act will expire five years after being enacted unless further action is taken to renew or extend them.

6. Conflict of Interest Prevention

The bill stipulates that federal agencies must include royalty payments in their evaluations of potential conflicts of interest for contractors or grantees seeking federal contracts. Annual reports must be made to Congress regarding any identified conflicts related to royalty payments.

7. Severability Clause

If any part of this act is found to be unconstitutional, the remaining provisions will remain in effect.

Relevant Companies

None found

This is an AI-generated summary of the bill text. There may be mistakes.

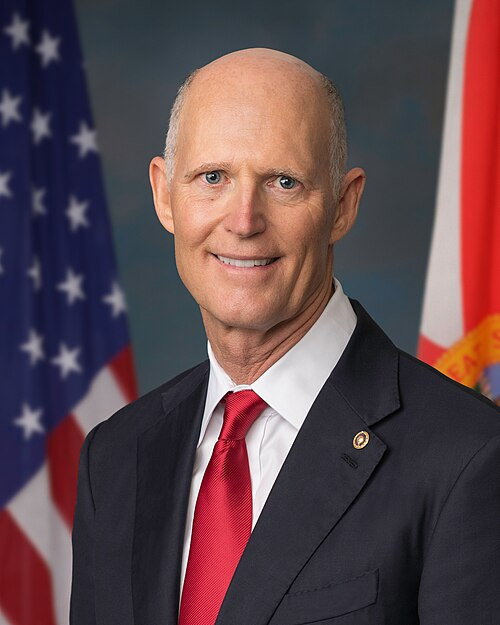

Sponsors

2 bill sponsors

Actions

5 actions

| Date | Action |

|---|---|

| Sep. 17, 2025 | Committee on Homeland Security and Governmental Affairs. Reported by Senator Paul with amendments. Without written report. |

| Sep. 17, 2025 | Placed on Senate Legislative Calendar under General Orders. Calendar No. 165. |

| Jul. 30, 2025 | Committee on Homeland Security and Governmental Affairs. Ordered to be reported without amendment favorably. |

| Mar. 05, 2025 | Introduced in Senate |

| Mar. 05, 2025 | Read twice and referred to the Committee on Homeland Security and Governmental Affairs. |

Corporate Lobbying

0 companies lobbying

None found.

* Note that there can be significant delays in lobbying disclosures, and our data may be incomplete.

Potentially Relevant Congressional Stock Trades

No relevant congressional stock trades found.